Challenges presented by business valuations based on comparison to completed transactions (“Done Deals”)

“Fair market value”–the highest price obtainable in an open and unrestricted market, between informed and prudent parties, under no compulsion to transact, expressed in terms of money or money’s worth–is a component of, or a starting point, for business valuation in many cases. For instance, it is generally the starting point for shareholder admissions and exits. It can be a starting point for “fair value” determinations (minority squeeze-outs, oppressed shareholder buy-outs). Sometimes, it is a measure of damages, particularly when the breach caused a termination of the entire business.

A common valuation technique for determining “fair market value” is the use of guideline transactions (“done deals”) or comparable companies. This is an appealing technique amongst non-valuators–it is relatable, understandable, and is thus inherently likeable. This article seeks to explore the uses and misuses of the technique.

What is it?

In the guideline method, a metric relating value of a similar company to something else (revenues, earnings, number of customers…) is calculated and applied to the subject company. “Company X sold for 10 times its pretax earnings” is the most common usage, but we also hear:

- “Oil and Gas Company sold for $X per barrel of proven reserves”;

- “The web site sold for $X per click”. In the early days of the web, websites that hadn’t generated positive cash flow were sometimes valued on this basis;

- “Cable TV Company sold for $X per subscriber”. This was common for cable TV and other subscription services, such as print media, although it is breaking down due to the disruption in these markets caused by the internet;

- “Drugstore Y sold for $X per prescription”. Although modern drugstores sell much more than prescription drugs, the prescriptions are seen as the value-driver, as they are what cause customers to return (and buy all manner of other things, while waiting for their refill);

- “Manufacturing Company sold for 5 times EBITDA”.

The comparison might be to a company that was itself subject to a purchase and sale. The comparison might also be to public companies (because, in a sense, every time a share trades in a public market, a small piece of the company is being bought and sold). This article focuses on problems presented in performing business valuation based on Done Deals (a subsequent article will deal with public company multiples).

A Word on Synergies

To understand some of the limitations of this method, we need to consider the concept of synergies.

Synergies are the reasons why a business can deliver more value after it is sold, than it could generate prior to sale. For instance, if the purchaser and the acquirer are in the same industry, there may be administrative cost savings. In their combined form, they may not require the same level of overhead as the two entities did in total, when separately owned.

Potential synergies are specific to the particular circumstances of the vendor and purchaser businesses, but might include:

- Enhanced purchasing power and resultant decrease in costs;

- A reduced cost of capital, if the businesses, in their combined form, are sufficiently large (larger businesses generally source capital at a lower cost than smaller businesses);

- Enhanced sales, due to enhanced product offerings, improved sales force efficiencies, or access to geographic markets not previously tapped;

- Economies of scale in production. If two competitors have below-capacity plants, then post-combination, there may be an opportunity to shut down plants;

- Operational advantages, including reduced warehousing and distribution costs;

- Strategic benefits such as proximity to customers.

Most “real world” transactions only occur because of synergies. Otherwise, there is little incentive to complete a deal–little reason for an acquirer to give over an amount of cash in exchange for assets of equal value. Transactions usually happen because a buyer can give over “X” in cash, acquire a business that was worth “X”, but make that business into something that delivers “X+”. The extent to which the acquirer paid an enhanced price (a “special purchaser premium”) for synergies specific to it varies. If the acquirer was the only bidder with potential post-acquisition synergistic enhancement, then the premium would have been very small.

Problems and challenges

The first problem faced is finding data on Done Deals.

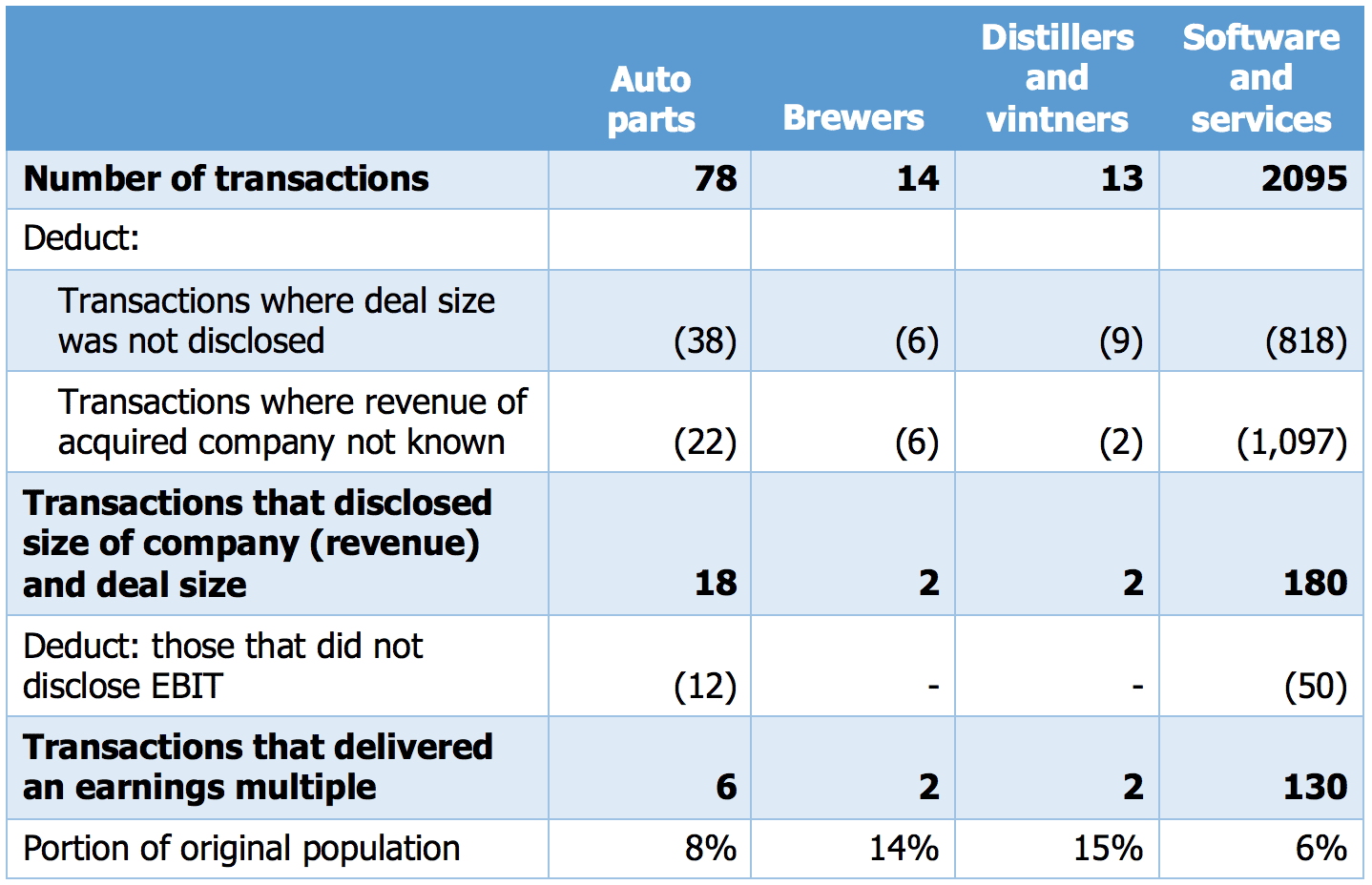

Below are the results of research[1] on three industries over a three year period:

- Auto parts, a traditional, “old world economy” industry with many participants;

- Brewers–because of the recent popularity of craft beer and spirits, market activity is anticipated in the industry;

- Distillers and vintners–for the same reason outlined above;

- Software and services, a “new world” industry with many participants.

Here is what the research showed:

As can be seen, other than the final group, roughly half of all transactions occur without any reporting of the transaction value at all. Another third did not disclose the size of the company (revenues), making comparison risky (one generally wants to compare companies of similar size). Only a small fraction disclosed an earnings multiple and the size of the company.

Those companies that did report likely did so because they were unusual, or atypical in some respect (something made them “report worthy” when most of their peers were not). Perhaps the target company, or more frequently the acquirer, was public and the deal was large enough to trigger the commensurate disclosure requirements. This means that those who did report are not “average” industry participants. So, drawing comparisons to them, for purposes of another valuation, could be risky.

The “Software and services” sector is tempting–while only 6% of all transactions reported an earnings multiple, the number of transactions, 130, might be viewed as a sufficiently large population. However, that optimism might be misplaced. Of those 130 companies, over 100 were very small–under $25 million per annum in revenues. If the subject company–the company whose fair market value the valuator is studying–is not in that range, the usefulness of the comparison is questionable. Only 28 of the 2,095 companies in the dataset had revenues in excess of $25 million. Depending on the circumstances, that may make reliance on the multiples unsafe.

Let us suppose that we can overcome these hurdles–that we examine “Done Deals”, and find a sufficient number of transactions reporting enough data, and within the relevant size range, to allow us to proceed. Should we march boldly forward, relying on the comparators?

Many valuators would remain skeptical. In most sectors, competitors are not performing the same service or selling the same product as each other. While those companies might be similarly classified by statisticians (they might bear the same SIC[2] or NAICS[3] code), they may have differences sufficiently great so as to compromise comparability. Consider:

- Auto parts: An after-market parts manufacturer is probably not comparable to an OEM supplier; the latter, for instance may enjoy minimum purchase volumes having been committed to by the manufacturer. But beyond that, is a supplier of parts to Tesla comparable to a supplier of GM? Are suppliers to GM, Ford and Chrysler-Fiat comparable to each other (with GM, Ford and Chrysler-Fiat varying in size and financial strength)?

- Furniture manufacturing: Is the company making furniture for IKEA (high volume, perhaps stable volumes in the short term, low margin, with no proprietary interest in the underlying design) comparable to a conventional manufacturer (higher margins, lower volumes, greater risk that a season’s offerings won’t be a success in the marketplace)?

It is often a subjective judgement that must be made to determine how dissimilar another company is, before it has become so dissimilar as to preclude it as a reasonable comparator.

And finally, other concerns must be addressed before relying on the done dealsanalyses:

- Fair market value, in a notional context, usually excludes any premium a buyer might pay for synergistic opportunities–the ability of the buyer to combine the business with another, and achieve some increased value. The premium is usually excluded from notional value determinations because it is almost impossible to value such synergies outside of the facts of a specific case (a particular buyer and a particular seller). But the comparable transactions, based on a “real” market, may indeed include such premiums. Hence, applying the comparables runs the risk of implicitly assuming every seller and every buyer would arrive at the same synergies, which is almost never the case.

- Finally, the metrics themselves must be considered. Was the earnings multiple based on historic earnings, and if so, were they “normalized” to remove unusual transactions? And how was the numerator, the deal price, measured? Actual deals frequently bear some form of deferred compensation (a portion of the purchase price being payable over time), participation (a portion of the purchase price being payable over time, and only based on subsequent earnings levels proving sufficient), shares in the acquiring company (which, even if the acquirer is public, might be restricted from trading for a period), and so on. All of these factors make it difficult to say the price at which “Company X” was sold. Accounting standards have improved in an effort to cause some uniformity in measuring transaction value, but remain inconsistent or perhaps not meaningful for the valuation exercise.

Where does this leave us?

This article has focused on reasons why guideline transactions or “Done Deals” analyses are not as determinative of fair market value as one might wish. But does that mean they have no role in business valuation?

Business valuation is a curious blend of art and science–objective measures mixed with subjective judgments. It is difficult to say exactly when the challenges outlined in this article are so great as to make a comparable analysis of not use at all. However, I suggest that only rarely can the potential shortcomings be sufficiently overcome that a Done Dealscomparison can be relied upon exclusively. If it is to be used, in most cases, it should be a secondary, backup method only.

[1] Source: S&P Capital IQ. Searches were for M&A, private placement, or buybacks from 2014 to 2016.

[2] Standard Industrial Classification.

[3] North American Industry Classification System.